Many of us choose to rent before we make that all important decision on buying a family home. It can be hard to know when the time is right to get a mortgage deposit together. We are here to help, so have put together a mortgage deposit tracker for you. This should help you to know when circumstances are right at first for making a commitment. We’ve also thought about other signs of when it is appropriate to take the plunge into the housing market and purchase your first family home.

This is a collaborative post.

Every set of circumstance for choosing to get a mortgage and purchase a house is different. However, there are a few pointers that will help you to decide if the timing works for you.

1. Stability at work

The first consideration when looking to move from renting to buying is the stability of you and your family’s income. Has it been consistent for a strong period of time? Are you able to prove this to lenders? If the income you have is a bit lumpy as you are a freelancer (for example), it can be a little harder to persuade lenders that you are a safe bet for a loan.

2. State of the housing market

This should be a consideration for you too. Is it a buyers or a sellers market? If this is a first time buy for you, then you want to make sure that you are in a buyers market. Do your research on the local housing market to check whether there are more or less properties on the market for the demand, and work out where the market sits for you.

If you have to delay that all important family house purchase, use the time to get yourself a tidy deposit.

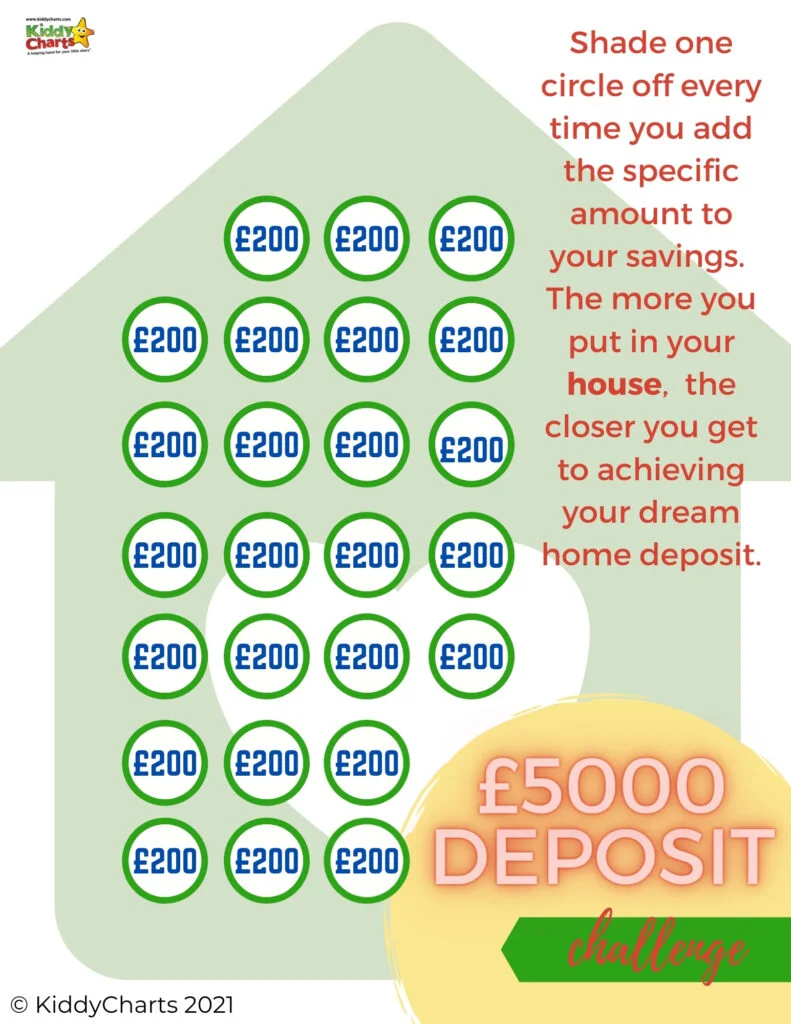

3. Ability to save for a mortgage deposit: Free deposit tracker

One of the most important indicators that you are able to enter the housing market is the ability to save for that all important mortgage deposit! Getting enough to buy a house for the family can be enough motivation to get on with it, but just in case you need a little extra help, we have put together a little deposit tracker for you.

This free printable includes:

- Sheet to track £5000 mortgage deposit,

- Another one covering $5000 of investment, and

- Blank sheet with 25 blank spaces so you can put in your own amounts in for the mortgage deposit that you are aiming for.

To download the sheet, just click on the circular image below and it is yours.

4. Can you afford ALL the fees and the mortgage?

Buying a house isn’t just about the deposit though, you have to take into account the other fees involved within the purchase to decide what you need to save to help purchase a new family house. Other fees involved might include:

- Stamp duty (in the UK),

- Solicitor / Lawyer’s fees for the conveyancing,

- Search fees concerning the property that you are buying,

- Survey fees for the property,

- Removal fees, and

- Making sure that you can afford the monthly mortgage payments. There are some really helpful sites out there with mortgage calculators that can really help you visualise the expenses you would incur depending on the size and interest rates for mortgages on the market.

Don’t forget to factor all the expenses into deciding what you can afford to spend, and that’ll help you decide if you are ready to commit.

5. Family certainty

Family can be in a state of flux – we might not have decided where we want to live relative to our other family members. Alternatively, we might not be sure how big a family we would like. That’s all fine, but in order to buy, it would be helpful to have a view for a longer period of time; you don’t want to be buying a place and then find you need to move the family home in a few years time because priorities have changed.

Consider what you want in a family home, and whether those ideas mean that you can commit to a place, and a size of house for at least 5 years, or for the period that YOU want to settle for. Chat honestly with all those involved; kids, partners, and other family members. If you are sure that you won’t have to change location again soon, then it might be the right time to set down those buying roots.

We do hope that these ideas have helped make things clearer, and that you like the mortgage deposit tracker we have put together for you as well. Here are some more thoughts on budgeting from the site for you:

Budgeting content on KiddyCharts

Here are some other ideas about budgeting on our site - why not go and take a look?

Simple tips for budgeting when you are starting a family

Ideas for budgeting when you are looking to start a family.

4 rules to live by for feeding a family on a budget

Great rules to live by when you are feeding a family to a tight budget.

Six week family meal plan

An amazing six week meal plan to help you with your budgeting - we KNOW this will make a massive difference to you all.

We do hope you like this article, and don’t forget to check out the other budgeting content that we have on the site too.

Sign up to our fabulous newsletter as well!

Lovely to see you on the site and hope to see you again soon,

Helen